If your charity last did an annual return before 12 November 2018

The Charity Commission changed its systems on 12 November 2018. If you have not submitted an annual return online since then, you鈥檒l need to do things differently.

Before you can start your annual return you must confirm all your charity鈥檚 details are correct, including all trustees鈥� contact details.

You cannot start your annual return until you鈥檝e confirmed your charity鈥檚 details. It might take you a while to collect any missing information, for example all trustees鈥� email addresses and phone numbers.

What your charity needs to do

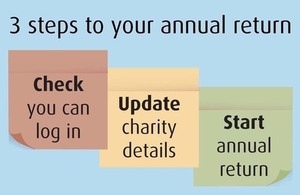

We recommend you:

- Check you can log in to your charity鈥檚 account.

- Collect information and use the service to confirm your charity鈥檚 details.

- Start your annual return.

1. Check you can log into your charity鈥檚 account

You鈥檒l need your charity鈥檚:

- registration number

- password

If you cannot log in and do not have access to your charity contact鈥檚 email address, it can take up to 2 working days to get a new password.

or find out how to get a new password.

2. Collect information and use the service to confirm your charity鈥檚 details

and select 鈥楿pdate Charity Details鈥� from your list of available services. You鈥檒l need to check and confirm all your charity鈥檚 contact and administrative details we have on record are correct.

If any of this information is missing on your charity鈥檚 record, you鈥檒l need to fill it in. Leave enough time to be able to check details with all your trustees and people who manage your charity鈥檚 finances.

Find out how to use the new 鈥楿pdate Charity Details鈥� service for the first time

3. Start your annual return

After you have submitted your confirmation of your charity鈥檚 details you can start your annual return:

- Check what your charity needs to submit.

- Gather information.

- and select 鈥楢nnual Return鈥� from your list of available services.

If your charity鈥檚 income is over 拢10,000, or it is a charitable incorporated organisation (CIO), you鈥檒l also need to check if any of the new questions on the annual return apply to your charity.